nebraska sales tax rate on vehicles

1st Street Papillion NE 68046. The Nebraska state sales tax rate is currently.

States With Highest And Lowest Sales Tax Rates

Enter zip code of the sale location or the sales tax rate in percent Sales Tax.

. The Cheyenne County sales tax rate is. This rate includes any state county city and local sales taxes. 31 rows The state sales tax rate in Nebraska is 5500.

The latest sales tax rate for Lincoln NE. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. Taxes in Nebraska Sources of Major State and Local Taxes Motor Vehicles DATA.

The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. 150 - State Recreation Road Fund - this fee. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660 Total.

800-742-7474 NE and IA. Sales Tax Rate Finder. Motor Fuels Taxes and Vehicle Registration Fees.

To review the rules in Nebraska visit our state-by-state guide. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

2020 rates included for use while preparing your income tax deduction. With local taxes the total sales tax rate is between 5500 and 8000. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

With local taxes the total sales tax rate is between 5500 and 8000. Vehicles are considered by the IRS as a good that can be purchased sold and traded. Has impacted many state nexus laws and sales tax collection requirements.

Additional fees collected and their distribution for every motor vehicle registration issued are. Sales Tax Rate s c l sr. The growth rate in inflation over this period was 237 and the growth rate in the economy as measured by Nebraska personal income was 411.

When the officer approached the vehicle the driver took off and dragged the officer with them. The Nebraska state sales and use tax rate is 55 055. Automating sales tax compliance can.

19 hours agoPolice said they were conducting a traffic stop with a vehicle that was involved in a road rage incident. Sales and Use Taxes. There are no changes to local sales and use tax rates that are effective January 1 2022.

However the car sales tax varies by state and some states dont even charge tax. The state capitol Omaha has a. Money from this sales tax goes towards a whole host of state-funded projects and programs.

Just enter the five-digit zip code of the location in which the. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. How Does Sales Tax Apply to Vehicle Sales.

Waste Reduction and Recycling Fee. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. The 2018 United States Supreme Court decision in South Dakota v.

Please select a specific location in Nebraska from the list below for specific Nebraska Sales Tax Rates for each location in 2022 or calculate. This is less than 1 of the value of the motor vehicle. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality.

The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax on cars is 5. DMV fees are about 765 on a 39750 vehicle based on a percentage of the vehicles value.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. MOTOR FUELS TAXES AND VEHICLE REGISTRATION FEES NOTE.

View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. Sales tax must be paid on all new or used vehicles within the first 30 days following the purchase in order to prevent a penalty. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E.

Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. Most states in the US charge sales tax on cars.

There are no changes to local sales and use tax rates that are effective July 1 2022. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. FilePay Your Return.

Nebraska Department of Revenue. The Nebraska NE state sales tax rate is currently 55. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value.

Nebraska has recent rate changes Thu Jul 01 2021. In the table below we show the car sales tax rate for each state.

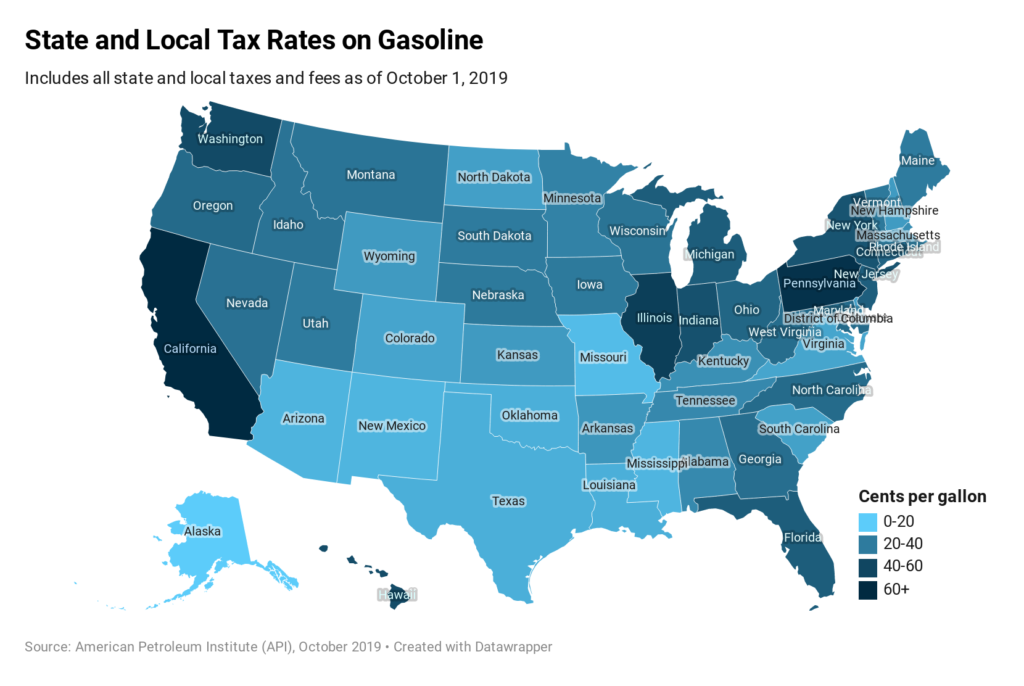

What Is The Gas Tax Rate Per Gallon In Your State Itep

Sales Taxes In The United States Wikiwand

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nj Car Sales Tax Everything You Need To Know

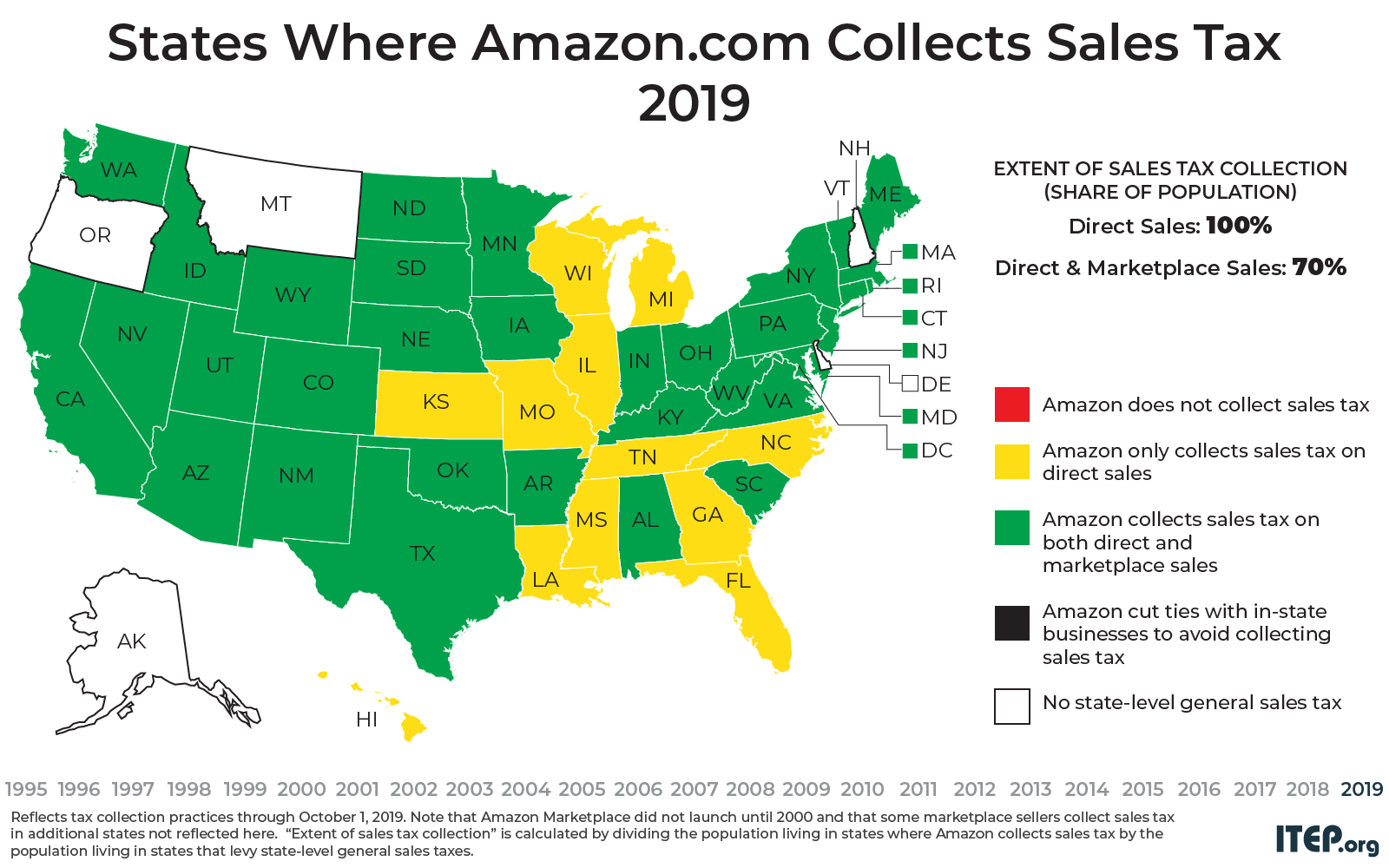

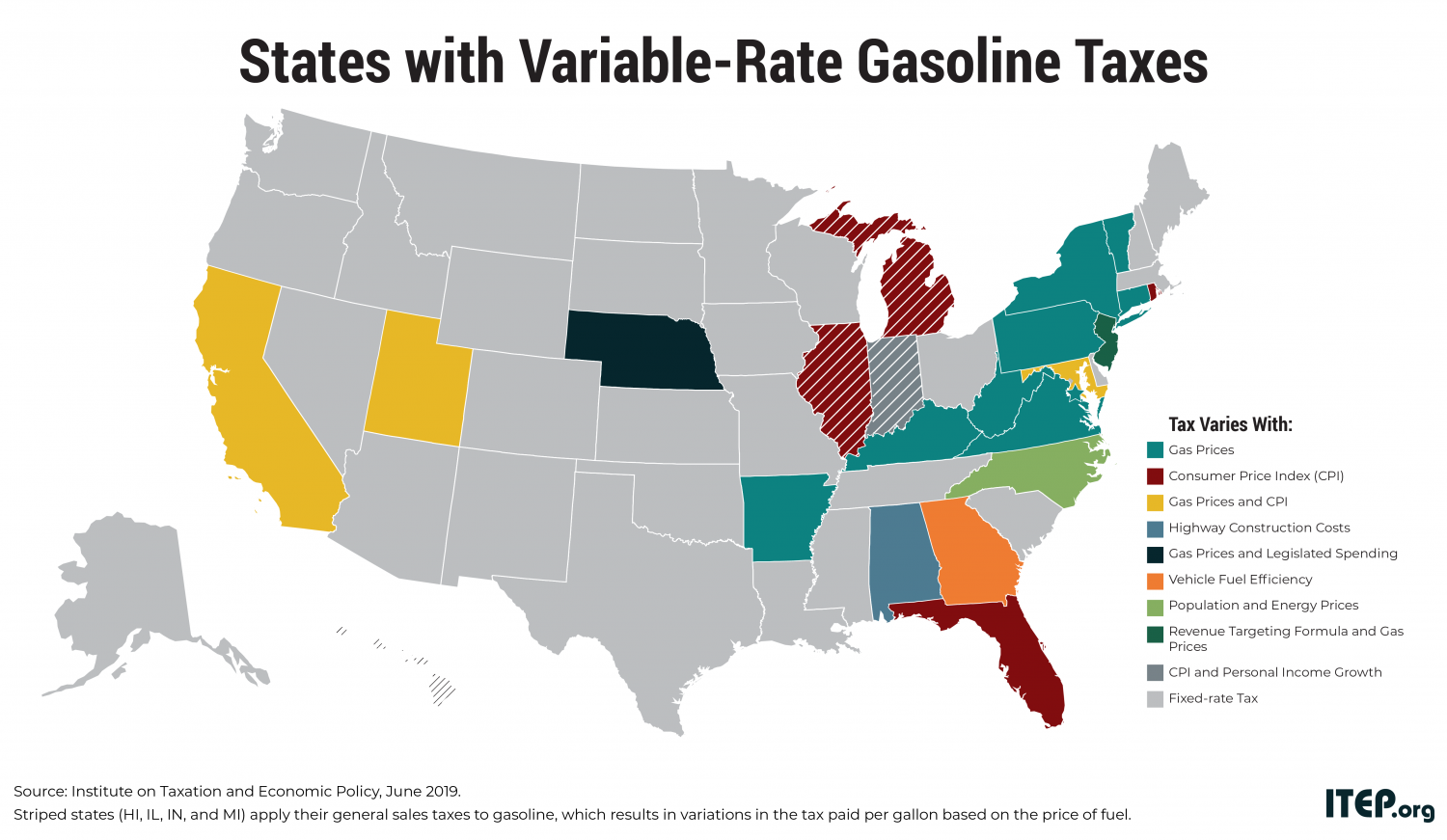

Most Americans Live In States With Variable Rate Gas Taxes Itep

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

What S The Car Sales Tax In Each State Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Sales Taxes In The United States Wikiwand

Sales Tax On Cars And Vehicles In Nebraska

Nebraska Sales Tax Small Business Guide Truic

State Taxation As It Applies To 1031 Exchanges

How Is Tax Liability Calculated Common Tax Questions Answered